Last quarter was a phenomenal one by almost any standards for a wide range of risk assets in a large part of the globe.

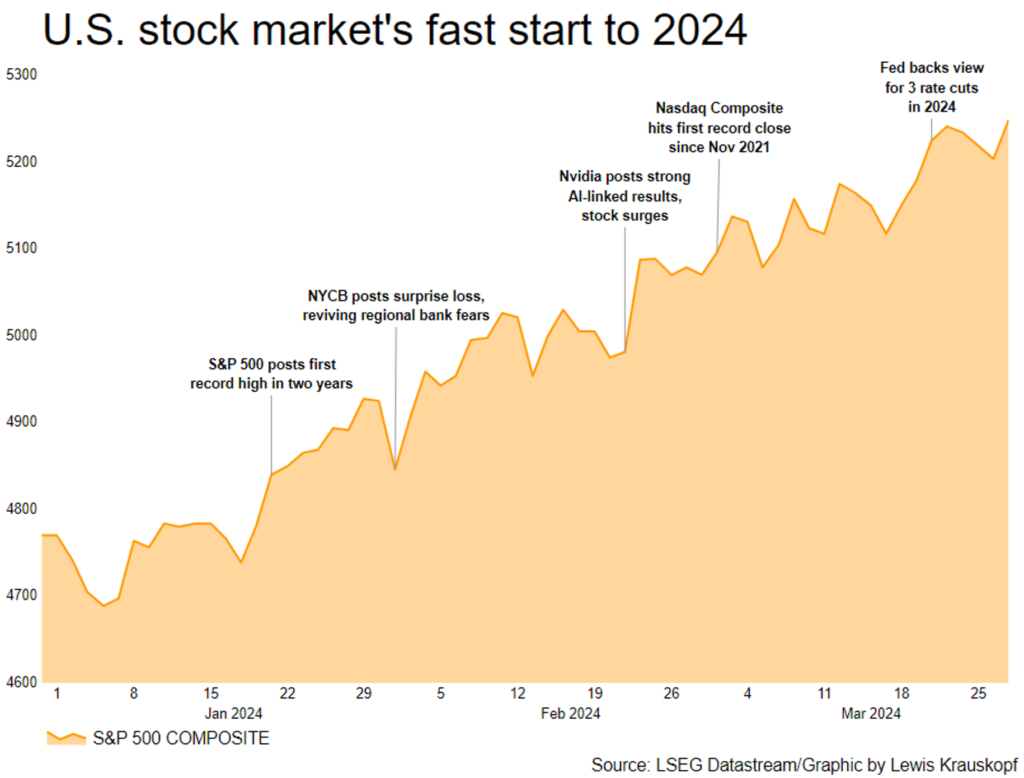

The S&P 500 climbed nearly 10% to post its biggest first-quarter gain since 2019. The benchmark index in late January hit its first record high in two years.

From <https://www.reuters.com/markets/us/how-us-stock-market-rocketed-through-first-quarter-2024-03-28/>

But markets are forward looking, by definition. So… Great quarter, but – will it do the same this quarter?

Before we answer that, we know it can be easy to look ahead to the future in anticipation. However, looking back at the past can be fruitful because trends tend to repeat themselves. When we look back at the momentum, we see a differentiator… AI. From our perspective, AI has a bright future impacting the markets.

As Q2 kicks off, we believe a slight pull back is due. However, we think it to be more of a supportive near-term backdrop for risk-taking. This could broaden out beyond tech as more sectors adopt AI and market confidence continues. If that occurs in an election year, we may see a continuation of first quarter returns.

This of course would also be the time to review your overall financial preparedness in other areas of your wealth. With earnings season beginning in a few of weeks, that mild pull-back we just spoke of could bring with it a “sell in May and go away” market prompting tax planning and risk management opportunities.

So let’s take a quiz to make sure you are ready. If you cannot say yes to all three of the below questions, you may want to give us a call to review your planning needs.

I have…

- At least 3 months of emergency savings

- A written plan if tragedy occurs

- Insurance covering at least 3 years of expenses for loved ones

iPlan. Do you?

Follow this link to schedule an online meeting at your convenience!