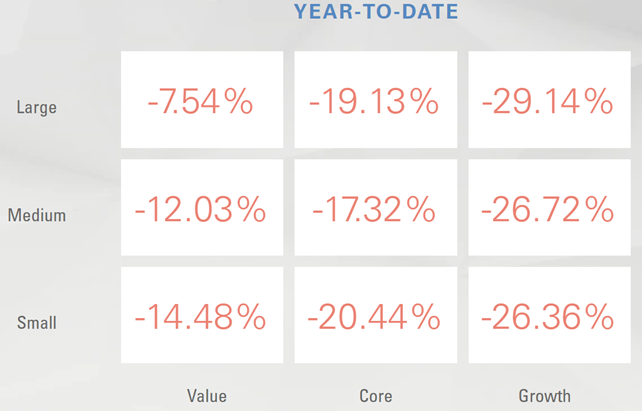

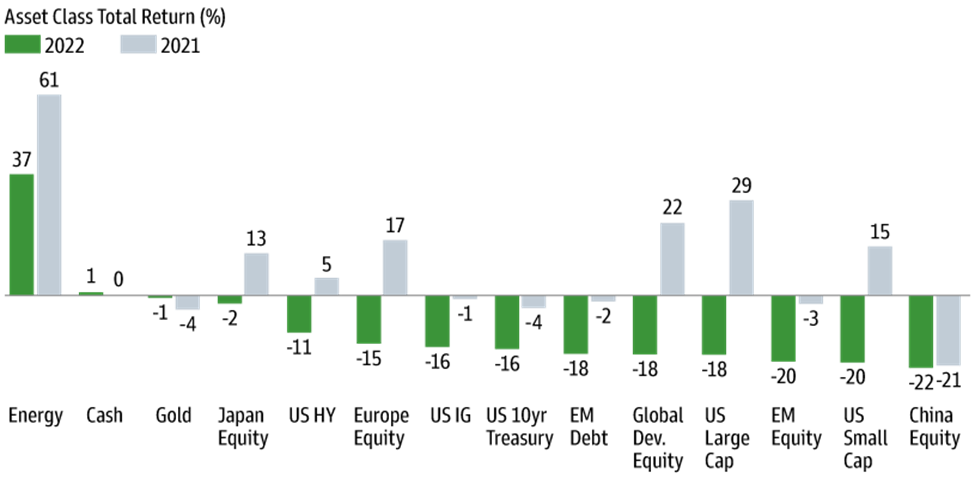

For 2022, the Dow Jones declined -8.8%, the S&P 500 lost -19.4%, and the Nasdaq collapsed by -33.1%! It is essential to say that the annual percentage declines for all three indexes were the biggest since the 2008 financial crisis! Moreover, sanctuary could not be found in bonds.

The U.S. Federal Reserve hiked the benchmark interest rate to 4.5%, which is the highest level since the 2007 year. They started the year at 0.00-0.25% and it ended the year at 4.25-4.50%, with a strong hint that it will move higher in 2023. As a result, bonds turned very negative creating a flight to cash as rates rose and valuations fell.

Meanwhile, Russia’s act of unprovoked aggression was among the biggest messes of 2022 and it is still a mess creating elevated geopolitical tension to such a degree that President Putin has threatened the use of nuclear weapons. While the direct effects have been devastating for Ukraine, the indirect effects on energy supplies for Europe and global food supplies have created their fair share of damage beyond Ukraine’s borders. So yeah, we are happy 2022 is over.

So what’s in store for 2023? Is there any hope for change?

2023 will more than likely be a continuation of the same for the first two quarters, through June. However, during that time – eyes will be front and center on how the rise in rates will impact growth. China will also be a major draw as they re-open from Covid-19. Depending on the above and aforementioned, a cautious outlook seems prudent. One key issue is the labor market. Despite rising rates, low unemployment has remained strong even though wages have failed to keep up with inflation and the overall cost of living. So there is hope.

At iPlan, we are looking at opportunities in healthcare, utilities, industrials and communications. We are still very cautious focusing more on value than growth, but overall feel that strategic planning will win in the long-term. We also feel that Financial Planning will play a larger role going forward. Portfolios that are positioned as they were 10 years ago will struggle in this new market. They will not make back losses as they did in the past because of increased market volatility. By combining the planning aspect with investing goals, both businesses and households should be able to retain more of their income for discretionary use.

So what should you do?

2023 will provide opportunities for investors. However, it will be more strategic. For the past decade all you had to do was be in the market. Today, you not only need to be in the market, but you need to know where GLOBAL economies are going and how that move impacts your goals. Moreover, cash will play a major role both for buying opportunities and for hedging risks against market pullbacks.

Bottomline, this year will be the year of “buying the dip.” While we agree, we don’t think we are there yet. We are targeting closer to the second or third quarter for that – grasping a better hold on recession fears. That along with strategic buying and financial planning, 2023 could prove to be a pivotal year for decent growth going forward!