Before I begin, my thoughts go out to those both preparing for hurricane Milton and those impacted by hurricane Helena.

Intro

For a while this summer, it looked like the bull market in stocks was in trouble. But by the end of the third quarter, stocks were back to posting new record highs.

Bonds also chalked up solid performances in the quarter, thanks to ebbing inflation and the Federal Reserve cutting interest rates (and doing so in dramatic fashion).

While the broad stock market goes into the final months of 2024 having resumed its rally, under the surface, the returns look fairly different, thanks to a rotation out of the big tech names that had led much of this bull market. To close out the last quarter, we’ve gathered insights and perspectives from analysts discussing what they see and how we plan to navigate this last quarter.

Reading for the nerds

The third quarter of 2024 delivered another positive return with the S&P 500 gaining 5.4% and bringing year-to-date gains to a stunning 20.7% – as of Oct. 3, 2024. The focus of the quarter were the central banks. In early August, the Bank of Japan raised the target rate on Japanese bonds and reduced its bond purchases to try to support the yen. The result was a rapid unwinding of the yen carry trade, which likely helped push U.S. stocks lower by -8.5% before stabilizing and resuming their upward trend.

The latest jump in stock prices was a result of the U.S. Federal Reserve’s surprise 50 basis point rate cut in mid-September. The bold move by the Fed was the first rate cut in four years and signaled that they believe the price of money is too high and may lead to future economic weakness. Bonds rallied as rates fell and are now up nearly 5% for the year after spending the first half of the year in negative territory. Further, global market support was provided at the end of September by China’s central bank, which introduced a broad fiscal stimulus plan that drove emerging markets higher by nearly 9.5% for the quarter.

The U.S. economy remains on solid footing with second quarter U.S. GDP growth of 3% following a first quarter increase of 1.4% and estimates of 3.1% for the third quarter. Unemployment, which has trended modestly higher from 3.4 in January of 2023 to 4.2% in July of 2024, is likely the reason the Fed pivoted to a larger 50 basis point cut. Although the Fed has been the brunt of continuous criticism, they appear to have navigated uniquely difficult post-pandemic conditions to lead the economy to a soft landing. With rate cuts supporting stable growth and unemployment, we appear to be in a Goldilocks economy – not too hot and not too cold – it’s just right.

Reading for the …. “Just give me the facts”

The stock market has returned just over 20% as of this writing. Bonds have followed suit hovering close to 5% for the year. The “guessers” said interest rates would be reduced seven times in 2024, but so far, it’s only happened once. This provides a stark reminder that if someone tells you what is going to happen in the markets over the next year, they are actually telling you nothing (because there are no crystal balls when it comes to predicting the markets).

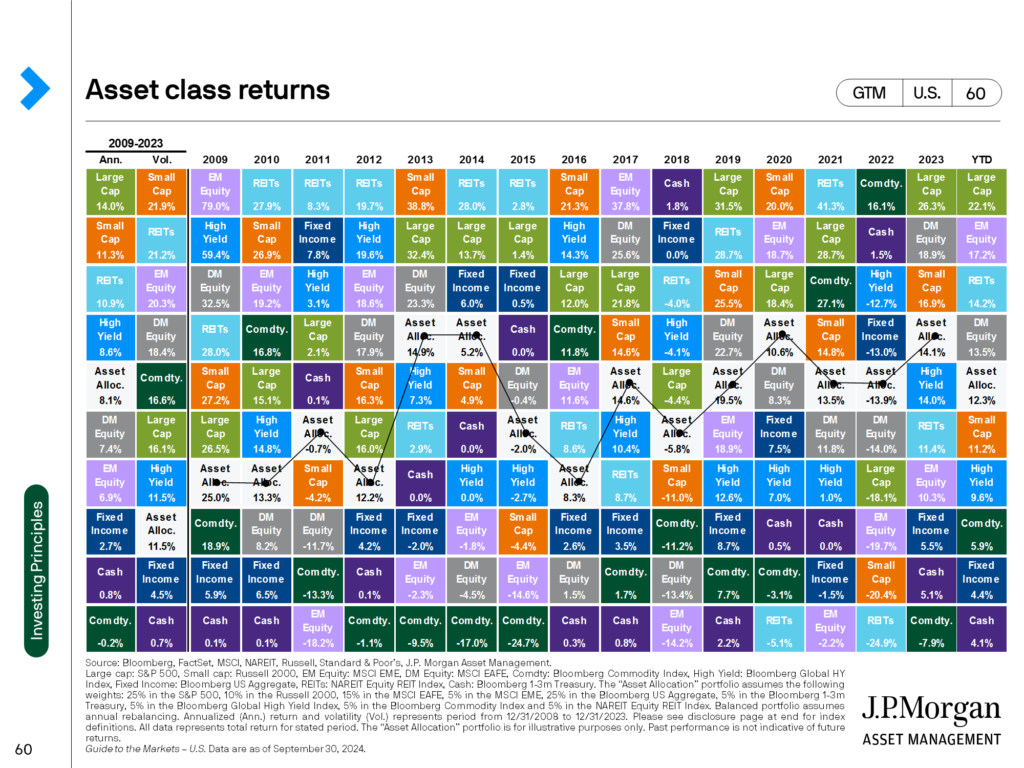

This year has reinforced the need to be unemotional while making investment decisions. Allowing fear to influence your investment decision-making, rather than following prudent investment fundamentals is a failed strategy nearly all of the time. Long-term investors who remained calm and stayed the course fared just fine. And those who used these momentary bouts of volatility to contribute to their investments (like bi-weekly 401(k)-type contributions), tax-loss harvest (to drive better after-tax returns) or put that extra money on the sidelines to work (cash underperforms stocks 100% of the time over a 20+ year period), were rewarded. Investing in the right type of accounts and prudent financial planning are so much more important and so much more within your control in comparison.

The world is a complicated place; it always has been and probably always will be. The remarkable thing is that we always find a way forward. The exact same tenets hold true for the economy and markets. Over the long run, a well-diversified investment strategy and prudent financial planning almost always win. We’re happy to report the markets are currently cooperating, but that can change just as quickly as the fall colors. Understanding and appropriately participating in the markets, while knowing this is how the seasons ebb and flow, allows for a much more enjoyable and vibrant experience.

Bottom line:

As always, we recommend remaining focused on your financial plan and not the ups and downs of markets. We remain focused on our disciplined investment processes to provide well-designed, tax-efficient, globally diversified portfolios that suit our clients’ investment planning needs.

Until then, please stay safe during this storm.

sources: https://www.morningstar.com/markets/q3-review-q4-2024-market-outlook, https://creativeplanning.com/insights/investment/q3-2024-market-commentary/, https://www.affiancefinancial.com/news/fall-2024-market-commentary, https://rivettifinancial.com/3rd-quarter-2024-market-summary/, https://www.owenanalytics.com.au/2024-10-05-three-quarter-score-check-2024