At the start of this year, Wall Street managers and analyst reported that 2023 would not be a great year to invest and investors should be defensive increasing their cash positions in lieu of expected volatility.

BlackRock’s Chariman and CEO reported in the eve of 2023 that Investment Managers should throw out their investment playbook, we’re headed for a ‘new regime of greater macro and market volatility.1 Fidelity is reported as saying “a recession is likely in the US…”2 Both Goldman Sachs and JPMorgan called for recessions. Bottom line, the markets have taken a lot of people by surprise in 2023. With many feeling jittery at the start of the year, most Wall Street managers simply missed the boat. On July 24th, the chief US equity strategist for Morgan Stanley conceded that he stuck with the pessimism for too long amid a rebound that has left equity benchmarks within spitting distance of erasing last year’s decline.

And so, here we are… halfway through the year where markets have performed much better than expected. But why did so many Wall Street managers and analyst get it wrong? Simple.. They followed history.

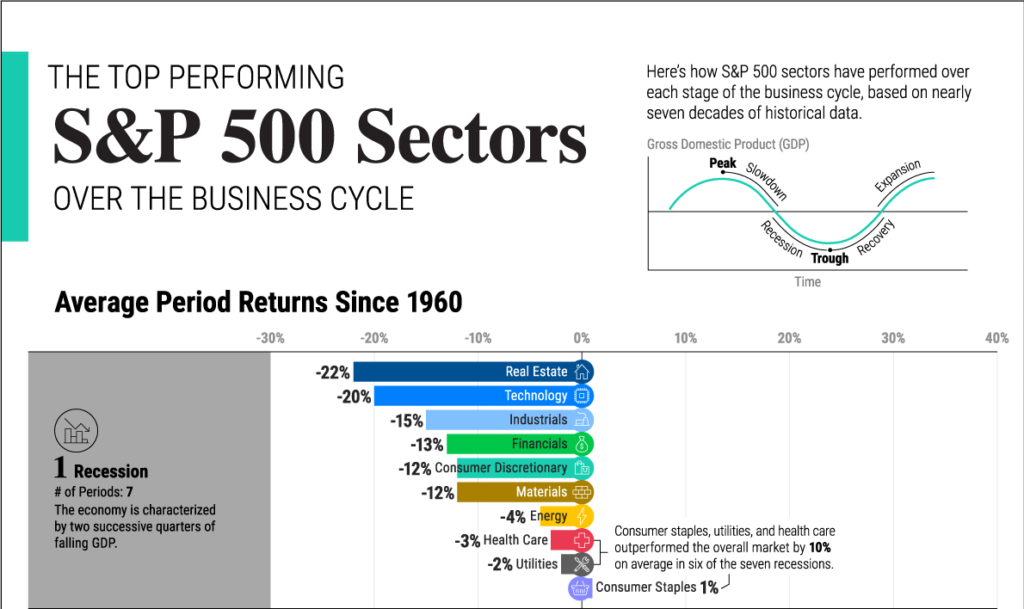

In a typical market, when one thinks a recession will occur, history has shown us to be defensive in a portfolio to mute losses. In doing so, one would hold more defensive positions like Healthcare, Utilities, Energy, etc. The rationale, despite a recession, households still need that service. Below, I’ve tried to illustrate the defensive portfolio approaching a recession:

Looking at the above illustration, you can see why managers gravitated to Energy, Healthcare and utilities. The losses were less severe when looking back at historical trends. This year, the market cycle was different. Employment remained low despite interest rate hikes and the consumer remained resilient despite inflation. Just look at sector performance as of July 31, 2023:

S&P 500 Sectors and the Market Cycle

Below, we show the 11 sectors in the S&P 500, organized by weight and their typical performance over the business cycle:

- Cyclical: Rise and fall with the market cycle, often correlated to expansions or contractions

- Defensive: Typically are negatively correlated to the market cycle, with more stable earnings and dividends

| Sector | Weight | As of July 31, 2023 Performance | Type |

| Information Technology | 26.1% | 45.8% | Cyclical |

| Health Care | 14.5% | -1.5% | Defensive |

| Financials | 12.9% | 3.1% | Cyclical |

| Consumer Discretionary | 9.9% | 35.5% | Cyclical |

| Industrials | 8.6% | 12.3% | Cyclical |

| Communication Services | 8.2% | 44.7% | Cyclical |

| Consumer Staples | 7.4% | 1.9% | Defensive |

| Energy | 4.5% | -0.5% | Defensive |

| Utilities | 2.9% | -5.0% | Defensive |

| Materials | 2.6% | 10.2% | Cyclical |

| Real Estate | 2.5% | 3.1% | Cyclical |

If you tilted your portfolio more to defense as suggested above, you can see how your portfolio fell behind actual index performance. It didn’t help that Information technology holds the lion share of weight in the S&P 500. Typically most managers under-weight technology being history has shown during a recession, tech fell amongst the worst.

So what now? With markets warming up alongside the weather as we past the middle of the year, investors who have been holding onto cash are anxiously wondering, “Did I miss the boat?” In our opinion, you haven’t missed the boat but if you are holding more than 30% in cash, you are muting your returns. As of this writing, most of our clients are holding on average 13% in cash equivalents. This allocation allows us to be defensive yet participate in gains when they come.

I strongly suggest that if you are holding more than 30% in cash or cash equivalents, to give us a call to review with you your portfolio objectives and goals to ensure you have the right mix going forward. Happy Summer!!

Source:

- https://fortune.com/2022/12/09/how-bad-economy-next-year-blackrock-2023-economic-outlook-new-regime-investment-playbook/

- Wall Street Predictions for 2023: Global Recession, Bond Surge, Dollar Drop (bloomberg.com)

- https://www.visualcapitalist.com/the-top-performing-sp-500-sectors-over-the-business-cycle/

- https://www.visualcapitalist.com/complete-breakdown-of-sp-500-companies/

- Performance 2023 S&P 500 Sectors & Industries (yardeni.com)