During July, the S&P 500 was a bit more volatile than in past months despite ending in nearly the same place it started. The market rose through the first half of the month before reversing course despite most stocks in the index gaining value for the month.

The driver of recent market losses is the poor performance of the Magnificent Seven which collectively shed approximately $1.5 trillion in market value in the past three weeks, the biggest drop over such a stretch on record. Investors had continued to pour money into anything related to artificial intelligence (AI) this year. During the second quarter, within the S&P 500, companies related to AI gained 14.7% in market value, whereas the rest lost 1.2%. This year, the value of Nvidia (NVDA) had increased more than $2 trillion before its recent pullback.*

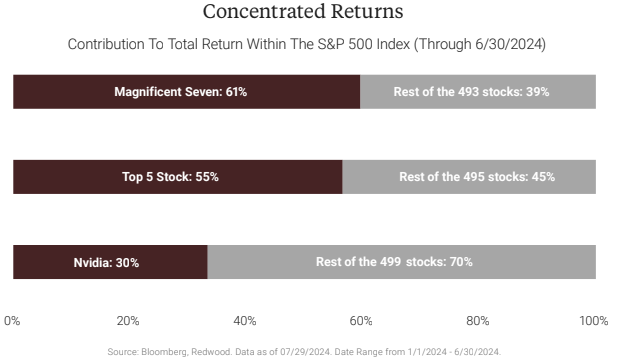

To put these numbers into perspective Nvidia accounted for nearly 30% of the S&P 500’s total return through 6/30/2024. In fact, if you include the other 6 players of the Magnificent Seven, you will find that they accounted for nearly 61% of the S&P’s return through the same time period. For reference, in the first half of the year, the S&P 500 index returned 15.3% through June 30, of this year. If you remove the Magnificent Seven, the remaining 493 positions gained only 5.97%!**

However, investors must remember that while concentrated positions can offer returns like we’ve seen during bullish trends, they also pose heightened risk – much like what we’ve seen throughout the month of July. Yet despite recent losses, valuations still remain high. As of this writing, the S&P 500 is down over 2% for the day (August 2, 2024). Likewise the Magnificent Seven. Again showing concentration has its risk.

But what about political or Central Bank pressure? How will that impact your portfolio? The Fed looks to begin cutting rates mid to late September. That could change, but for now we think we could see that happening. If they lower interest rates before the November election, there is a risk that Republicans will cast it as a politicized move meant to help Democrats: Lower borrowing costs can bolster the economy and markets.

On the flip side, if Trump were to win, one big question we would have is whether he would approach the Fed the way he did during his first term as president — regularly and loudly criticizing the central bank — or whether he would go further, potentially trying to fire Mr. Powell before his term expires. Whether a Fed chair can actually be fired is unclear. It wouldn’t be the first time a controversial change in the political theater occurred during a Trump Presidency.

At the end of the day, we still hold firm that maintaining a well-diversified portfolio along with annual financial planning will provide the re-assurance you need to reach a stated goal. Keeping to our recommendation, we encourage you to take advantage of our services if you haven’t done so. Planning can go a long way when you are interested in insulating your portfolio. To learn more, click here. iPlan. Do you?