The S&P 500 index gained a whopping 14.5% to close the first six months of 2024. The Dow Jones Industrial Average rose 3.8% and the Nasdaq Composite climbed 18.1%. Like much of 2023, there’s been one big driver behind the gains: artificial intelligence.

Similar to last year, a large part of this year’s gains were concentrated in the Magnificent Seven (Nvidia, Microsoft, Google, Meta, etc.), while other stocks have lagged behind. Despite ongoing inflation concerns, U.S. stocks finished higher on Tuesday after Federal Reserve Chair Jerome Powell acknowledged that inflation is back on a downward path — albeit noting that it is still too soon for the central bank to make a move on interest rates.

So, how do we see the market performing during the second half of 2024?

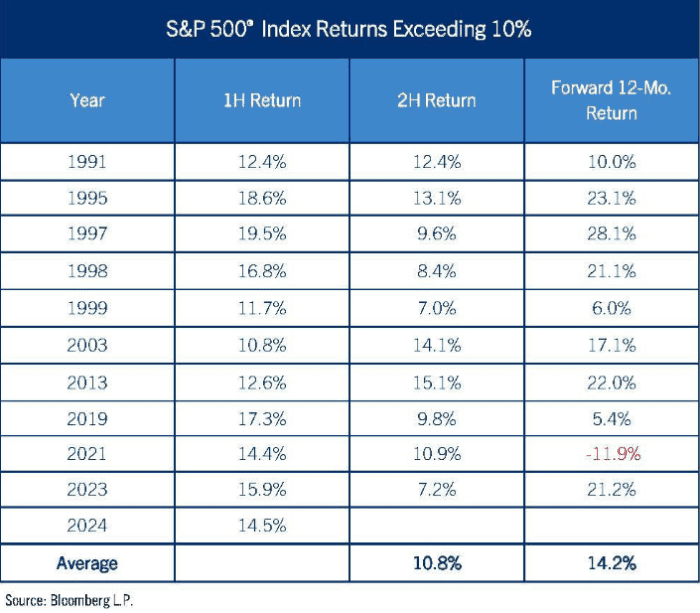

History suggests that strong first halves of the year generally maintain momentum throughout the second half. We also think the rally could continue barring obvious risk: War abroad, Fed Policies, Election. Since 1990, there have been 10 occasions where the S&P 500 has achieved a return greater than 10% in the first half of a year. In each instance, the large-cap benchmark index booked a positive return in the second half of the year, averaging a 10.8% return over the next six months, according to data compiled by Comerica (see chart below).

Meanwhile, presidential election years, particularly those where the incumbent president is running for re-election, have seen tailwinds pushing the stock market higher. Will this happen again? We tend to think it has the potential, but as with any investment decision, we encourage investors to prepare for contingencies.

Mid-year is a crucial juncture for you to take control of your investments and ensure they are in line with your long-term financial plan and any short-term financial needs. Conducting a review every six months is a wise practice. Doing it more frequently might lead to unnecessary changes due to market noise, economic fluctuations and news distractions. On the other hand, delaying it could result in a significant deviation from your target balance of stocks and bonds.

As you review your investments, keep in mind stock market volatility and the role of fixed income investments during the second half of the year. We still see value in holding a small weighting in fixed income instruments. They present a nice parking place for savings where rates are hovering just short of 5 percent. If you are strategically holding money-market funds, CDs, or short-term U.S. Treasury bills as an alternative to holding bonds, expectations of future rates may suggest a small shift back to bonds.

Economic growth appears to be slowing and this has led central banks abroad to begin reducing interest rates. The U.S. could follow suit. If it does, lower interest rates would immediately impact cash equivalent savings where bonds on the other hand, could experience a modest boost in the form of capital appreciation (value growth). As with any investment, discuss with your investment advisor options prior to taking any action.

That said, we hope you enjoy the food, fun and fireworks that come with celebrating this country’s independence.

Happy 4th of July!!

Sources:

<https://www.yahoo.com/news/time-mid-review-finances-thoughts-210452322.html>