6/28/22

| Dow Jones 31,501 (+5.39%) | S&P 500 3,912 (+6.45%) | Nasdaq 11,608 (+7.49%) | Bitcoin $21,435 (+4.85%) |

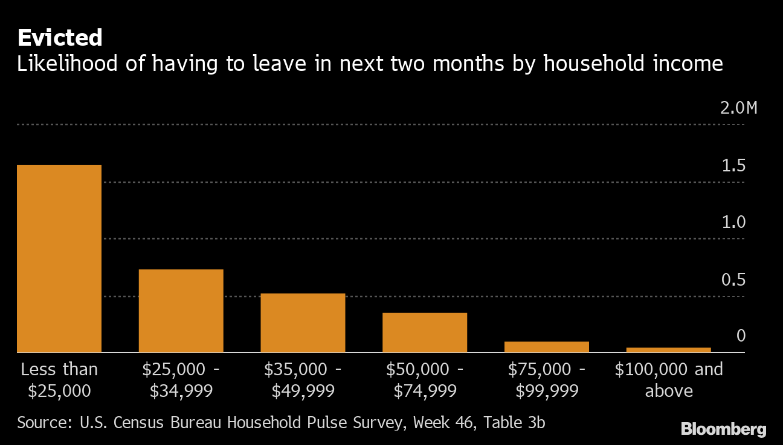

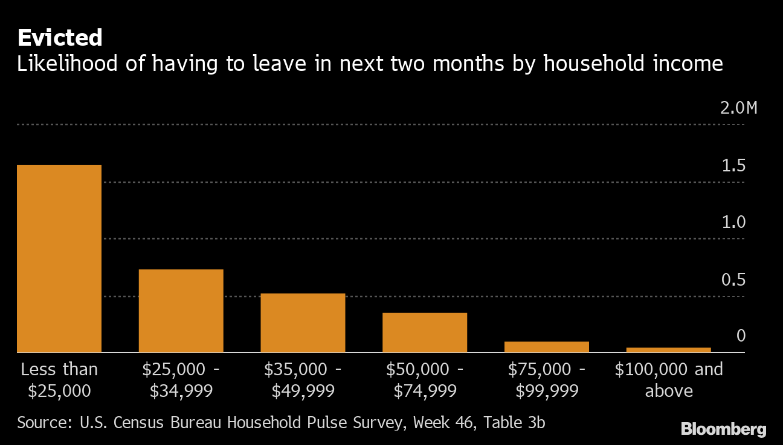

Last week saw a lot of green for the first time in weeks as Wall Street started buying in with prices depressed. This is following a trend of analysts remaining rather bullish despite the number of warning signs across the world. We are concerned that analysts are using numbers from 2021 which is not taking into consideration global contraction. If buyers follow this trend, they could potentially find themselves in bear rally losing value as opposed to a true bull rally. The chart below gives credence to our concern, showing that millions of Americans are falling behind on rent payments which can be an indicator of consumer spending.

Internationally, the conflict in Ukraine continues to threaten energy prices as Saudi Arabia is dancing around the idea of increasing output as they are enjoying surging margins. Tensions in Iran, Israel, Taiwan, and Syria will continue to drive international trading fear and will certainly not help supply chain crises. China has been significantly boosting bond sales to try to keep pumping their economy to keep it afloat. How long will this continue?

As the US dollar continues to dominate internationally, we are considering Dollar Cost Averaging into energy and healthcare. Our observation is showing us that European investments into the dollar is at all-time highs, but they are not investing in securities. This is stregthening the dollar but is also creeping up the cost of currency conversion. This too is a concern because when will it be too expensive to invest in U.S. securities. For now, we will continue holding higher than normal cash balances until we see the next inevitable downward trend. At that point we will begin to reposition at lower levels than are possible at this time.

Noteworthy News

The world’s bubbliest housing markets are flashing warning signs. Our Big Take highlights how 19 OECD members have combined price-to-rent and home price-to-income ratios that are higher today than they were before 2008—an indication prices are out of line with fundamentals.

US consumer confidence dropped in June to the lowest in more than a year as inflation continues to dampen Americans’ economic views.

The Conference Board’s index decreased to 98.7 from a downwardly revised 103.2 reading in May, data Tuesday showed. The median forecast in a Bloomberg survey of economists called for a decline to 100.

A measure of expectations — which reflects consumers’ six-month outlook — dropped to the lowest in nearly a decade as Americans grew more downbeat about the outlook for the economy, labor market and incomes. The group’s gauge of current conditions fell slightly.

Important events this upcoming week

- Wednesday: Earnings expected from Paychex, General Mills, McCormick & Co., MillerKnoll, and Bed Bath & Beyond

- Thursday: Jobless claims. Earnings expected from Micron Technology, Constellation Brands, Walgreens Boots Alliance, Acuity Brands, and Simply Good Foods

- Friday: Universal Pictures’ “Minions” premieres. Tour de France begins

- The weekend: US markets are closed on Monday for Independence Day